- #Credit score ranges equifax update#

- #Credit score ranges equifax free#

- #Credit score ranges equifax mac#

Individuals who are "rate shopping" for a mortgage, auto loan, or student loan over a short period (two weeks or 45 days, depending on the generation of FICO score used) will likely not experience a meaningful decrease in their scores as a result of these types of inquiries, as the FICO scoring model considers all of those types of hard inquiries that occur within 14 or 45 days of each other as only one.

#Credit score ranges equifax mac#

: 602 The FICO score burst into public consciousness in 1995 when Freddie Mac had lenders use credit scoring for all new mortgage applications. : 585ĭuring the 1970s and 80s, the credit reporting industry relentlessly consolidated : 598 and moved aggressively into prescreening. : 573 Credit scoring adoption accelerated to shield against discrimination lawsuits.

: 447 The Equal Credit Opportunity Act banned denying credit on gender or marital status in 1974, along with race, nationality, religion, age, or receipt of public assistance in 1976. During the late 1950s, banks started using computerized credit scoring to redefine creditworthiness as abstract statistical risk. History īefore credit scores, credit was evaluated using credit reports from credit bureaus.

#Credit score ranges equifax free#

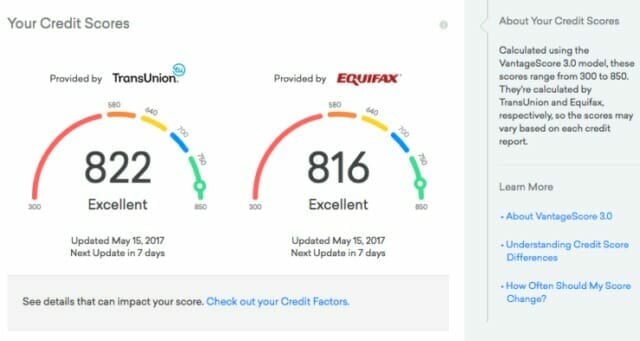

Under the Dodd-Frank Act passed in 2010, a consumer is entitled to receive a free report of the specific credit score used if they are denied a loan, credit card or insurance due to their credit score. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers.

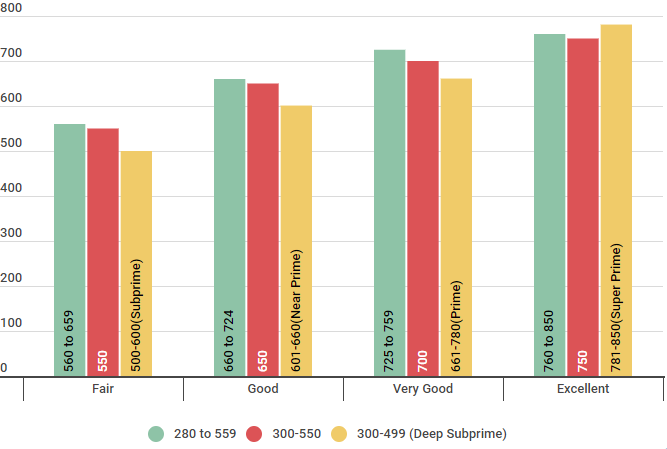

Lenders, such as banks and credit card companies, use credit scores to evaluate the risk of lending money to consumers. It is an inexpensive and main alternative to other forms of consumer loan underwriting. ( September 2020)Ī credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report.

#Credit score ranges equifax update#

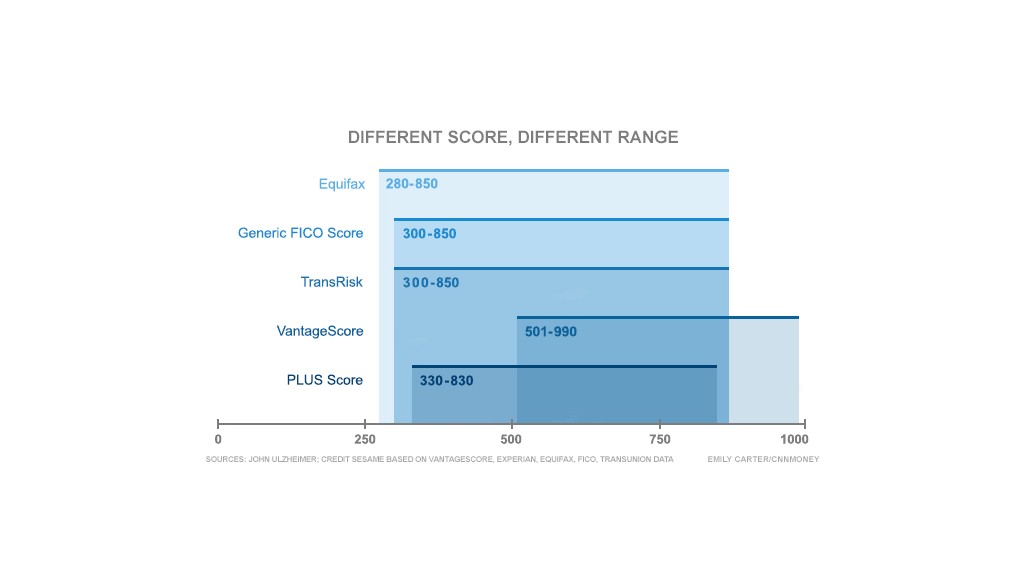

Please help update this article to reflect recent events or newly available information. If old names are to be included for historical purposes, they should be in a separate "history" section. Current nomenclature is a numbered FICO model with an optional industry type. The reason given is: References to "credit bureau branded" credit scores, like Beacon, NextGen, and Pinnacle are obsolete.

The factual accuracy of parts of this article (those related to Credit scoring models) may be compromised due to out-of-date information.

0 kommentar(er)

0 kommentar(er)